I know this is not the time for a long note on rebalancing theory and best practices. That said, current market conditions will make upcoming rebalancing challenging and expensive – maybe more so than at any time in memory. So here are the cold, hard facts. Each point has further detail below if you would like more details.

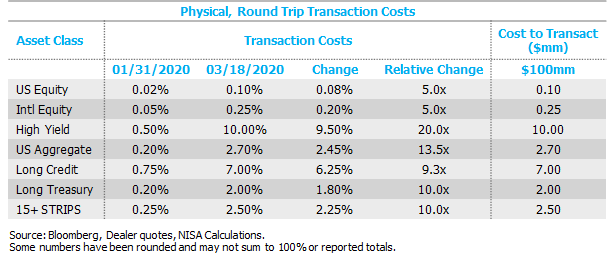

- Transaction costs in physical markets are up across the board, generally 5 times or more. In all markets except public equities, transaction costs are measured in points, not basis points. Even off-the-run Treasuries are trading in 2+ point markets.

- To move macro exposures (equities, rate, etc.), derivative markets remain vastly more liquid than their physical counterparts.

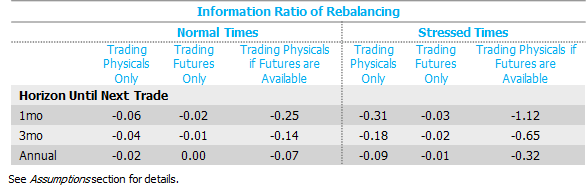

- Even with extremely high near term volatilities, the cost to rebalance may not be justified in light of the modest reduction of tracking error relative to policy allocations. For example, the decision to not rebalance from corporate bonds to equities, may have an information ratio right now of 0.3 to 1.1! (See analysis below.)

Bottom line: If cash is needed (for benefit payments, margin, capital calls, etc.) then of course asset sales are required.[1] If cash is not needed, consider utilizing derivatives to rebalance, widening the rebalancing boundaries, and/or delaying the rebalancing activity.

- Transactions costs are up. A lot.

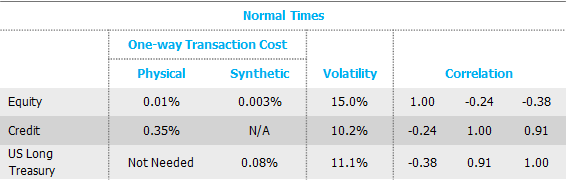

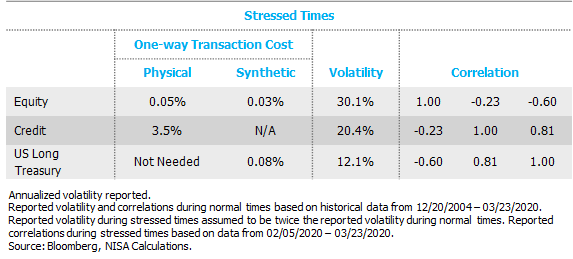

Here is a quick table to give you a sense of the magnitude of transactions costs currently. Transaction costs have increased 5 to 20 times in the current environment. For example, round trip transaction costs for $100mm of high yield are currently estimated to be $10mm. For investment grade long credit, the transaction costs are $7mm.

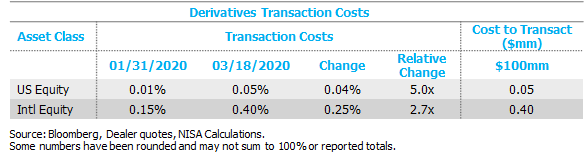

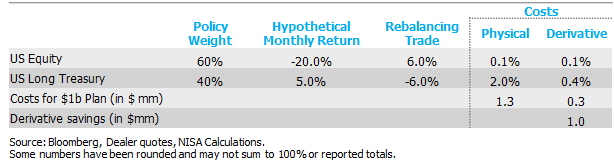

- Derivatives remain a very effective tool to rebalance macro exposures.

Given quarter to date market movements, clients are typically long Treasury or other rate exposure and short equity exposure. The costs of trading physical Treasuries have increased considerably – more than at any point we can remember, even during the Financial Crisis. Accordingly, utilizing derivatives to adjust broad exposures differences can result in meaningful savings. See example below.

- The information ratio to NOT rebalance has increased dramatically.

With transaction costs in physical markets at what feels like an all-time high, investors are effectively being paid not to trade. For example, liquidating corporate bonds to purchase equities currently costs 5-10%. The simple fact is that not rebalancing, when possible, gives an investor a “head start” on the potential slippage from deviating from their policy allocation. If the slippage from deviating is random (i.e. noise) then a useful way to measure this tradeoff is using an information ratio measurement.In “normal” circumstances, modest transactions costs can make more frequent rebalancing trades worthwhile. This is apparent by looking at the information ratio of the rebalancing trade. Information ratio represents the return per unit of risk. Since transaction costs can be thought of as negative return, the information ratio of trading is equal to the costs of the trade (negative) divided by the tracking error (“noise”) to the policy allocation that is eliminated by the trade.The table below uses the example of an asset owner that is overweight corporate bonds and underweight equity. The table shows that the “normal” information ratio of trading is quite low, depending on the rebalancing approach (physicals or futures) and horizon before the next rebalancing trade. However, with current transaction costs, the information ratio to defer the trade has jumped, particularly for any trade involving physical assets with high transactions costs. In the current environment, the information ratio of rebalancing with physicals is -0.09 to -0.31. If derivatives are available to adjust macro exposure per the discussion above, the information ratio to trade the physical securities jumps to -0.32 to -1.12. Said differently, the information ratio to NOT rebalance could be as high as 1.1 right now. The numbers above probably understate the case to avoid physical rebalancing since they ignore tracking error due to active management and other sources. The tracking error from a policy allocation mismatch does not increase the total tracking error of a portfolio by as much when there are other sources of tracking error. That is, 1% of tracking error from policy allocation mismatch added to 2% of risk from other sources of tracking error does not equal 3% of total tracking error, so long as the two sources of tracking error aren’t perfectly correlated. It is probably also worth acknowledging that active management tracking error is undoubtedly higher in this environment. If an investor has meaningful tracking error around their policy benchmark due to active management, the signal to noise ratio for any rebalancing trade is even worse right now, further arguing to avoid paying certain transaction costs in exchange for a debatable amount of net tracking error reduction. We spared you another set of numbers, but with very conservative estimates of active risk, the information ratio of rebalancing could easily be -3.0 or more! A last note on regret and market views. Delaying rebalancing runs the risk of regret in the event of a market rebound. If equity markets quickly recover and bond markets revert toward their pre-COVID levels, it would have been worth even the elevated transaction costs to rebalance. This, of course, is implicitly building a market view into the rebalancing trade and should be acknowledged as such. If an investor believes the market is a random walk from here on out, then the information ratio metric is a reasonable way to measure the trade-offs. If there is a view that the markets tend to mean-revert, that view increases the desirability of a rebalancing trade. This note is far from a comprehensive review of potential countermeasures investors can take in this environment as they consider rebalancing strategies. Please do not hesitate to reach out if you would like to discuss in further detail.

The numbers above probably understate the case to avoid physical rebalancing since they ignore tracking error due to active management and other sources. The tracking error from a policy allocation mismatch does not increase the total tracking error of a portfolio by as much when there are other sources of tracking error. That is, 1% of tracking error from policy allocation mismatch added to 2% of risk from other sources of tracking error does not equal 3% of total tracking error, so long as the two sources of tracking error aren’t perfectly correlated. It is probably also worth acknowledging that active management tracking error is undoubtedly higher in this environment. If an investor has meaningful tracking error around their policy benchmark due to active management, the signal to noise ratio for any rebalancing trade is even worse right now, further arguing to avoid paying certain transaction costs in exchange for a debatable amount of net tracking error reduction. We spared you another set of numbers, but with very conservative estimates of active risk, the information ratio of rebalancing could easily be -3.0 or more! A last note on regret and market views. Delaying rebalancing runs the risk of regret in the event of a market rebound. If equity markets quickly recover and bond markets revert toward their pre-COVID levels, it would have been worth even the elevated transaction costs to rebalance. This, of course, is implicitly building a market view into the rebalancing trade and should be acknowledged as such. If an investor believes the market is a random walk from here on out, then the information ratio metric is a reasonable way to measure the trade-offs. If there is a view that the markets tend to mean-revert, that view increases the desirability of a rebalancing trade. This note is far from a comprehensive review of potential countermeasures investors can take in this environment as they consider rebalancing strategies. Please do not hesitate to reach out if you would like to discuss in further detail.

Assumptions

[1] For clients that have repo documentation in place and unencumbered physical Treasury securities, an asset sale may not be necessary to generate cash.