Derivatives Market Overview

January 2026

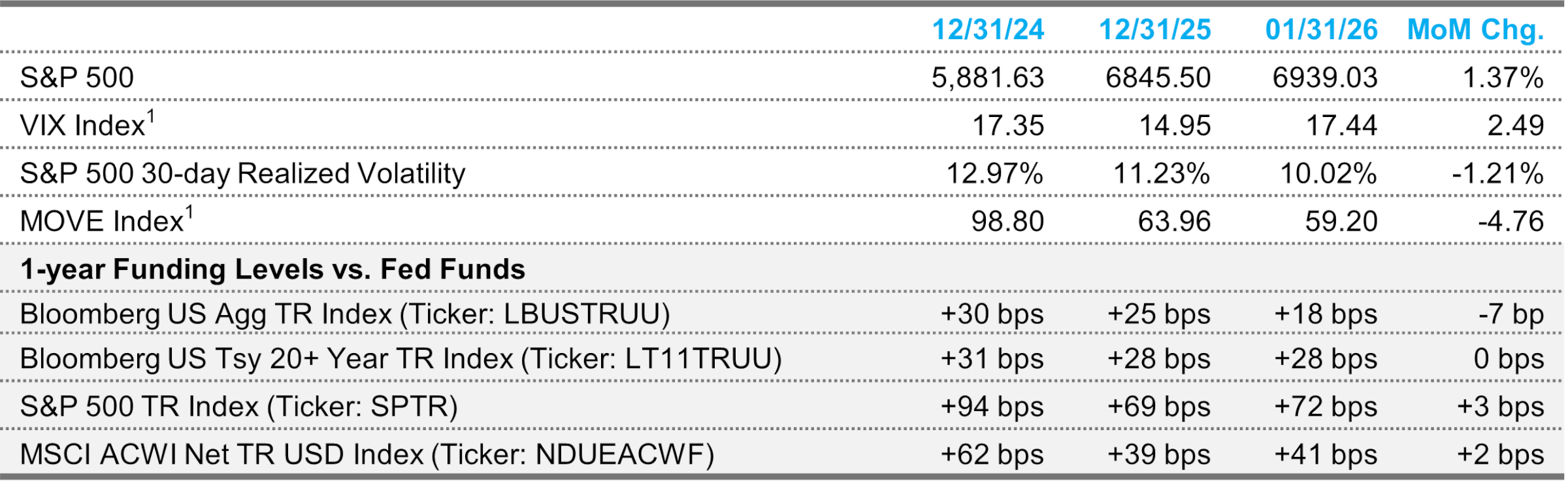

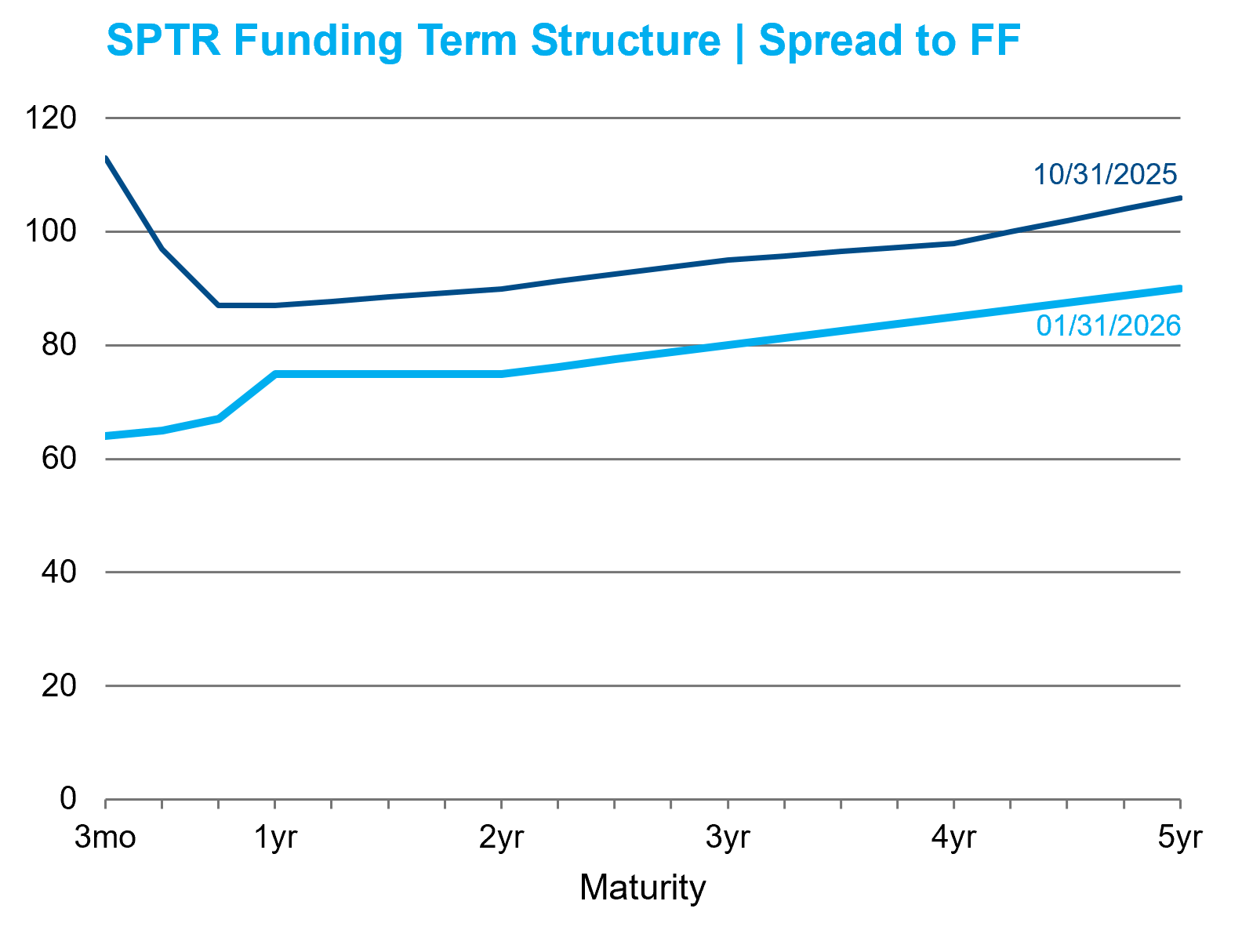

Funding Markets

Short-term equity funding costs have decreased in recent months with year-end pressures now in the rearview mirror. 3-month financing spreads for SPTR have fallen from 113 bps in October to 64 bps as of January 31, 2026. Longer-term funding costs have also declined, although they remain elevated relative to historical averages, with 5-year total return swaps trading at a 90-bp spread to the Fed Funds rate.

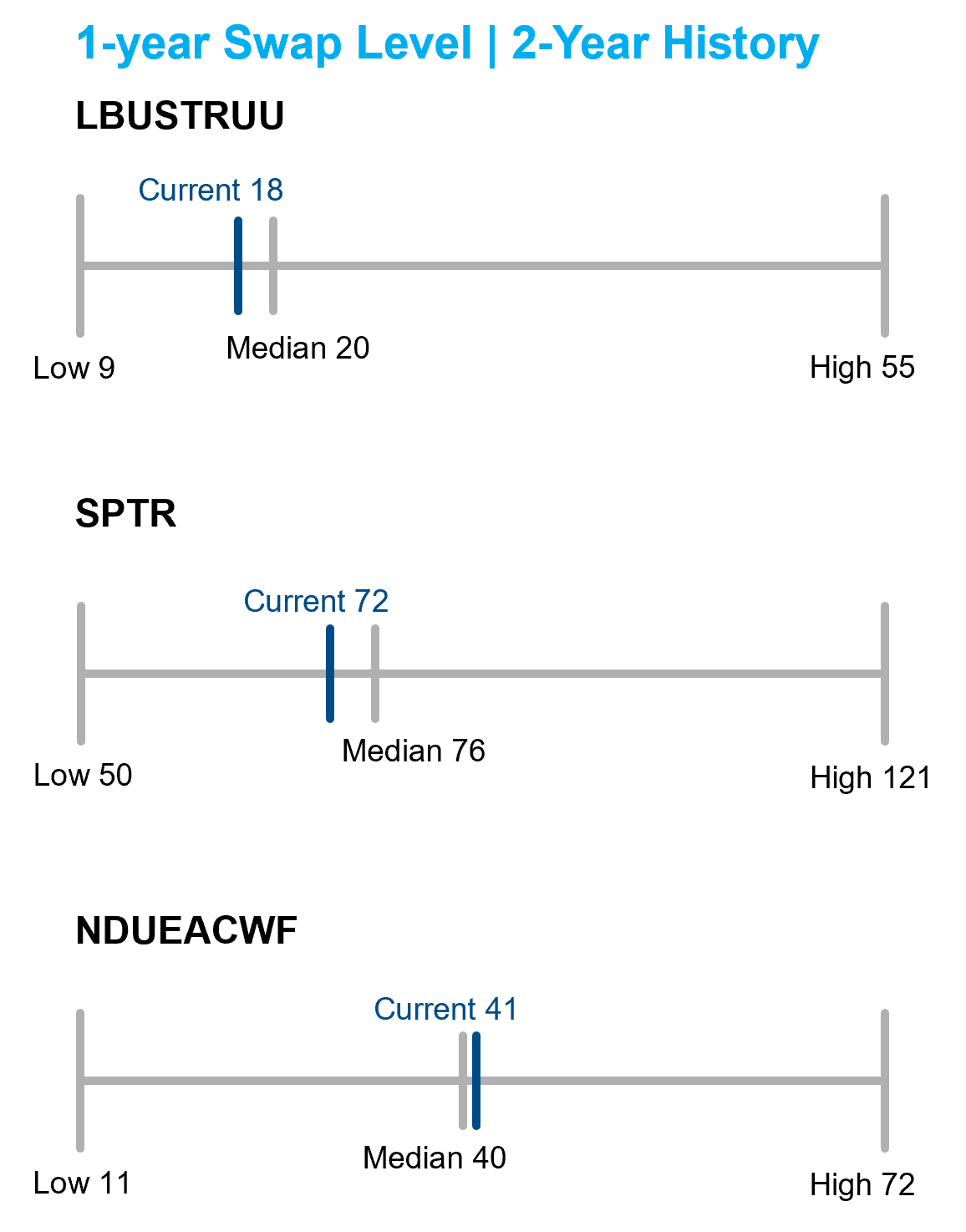

One-year funding levels continued to trade near the median level of the prior two years across equity and fixed income markets.

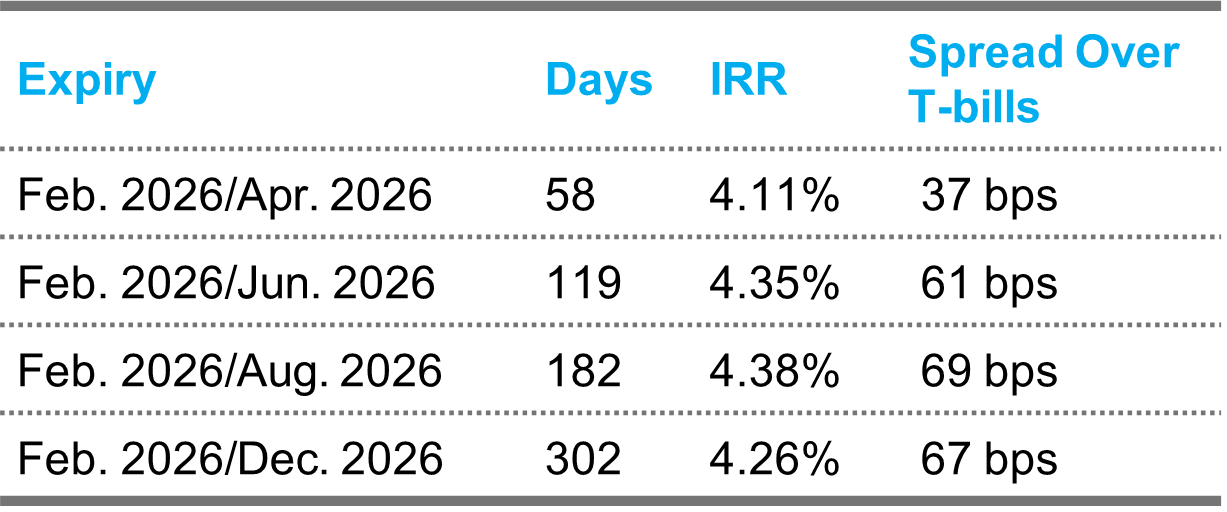

Gold Cash and Carry

Cash-and-carry strategies seek to earn a positive financing spread after adjusting for carrying costs. The strategy buys a near-dated futures contract (e.g., February 2026) with the intent of taking delivery of the physical asset and sells a far-dated futures contract. The financing levels in the table account for storage costs associated with taking physical delivery of gold.

Volatility Markets

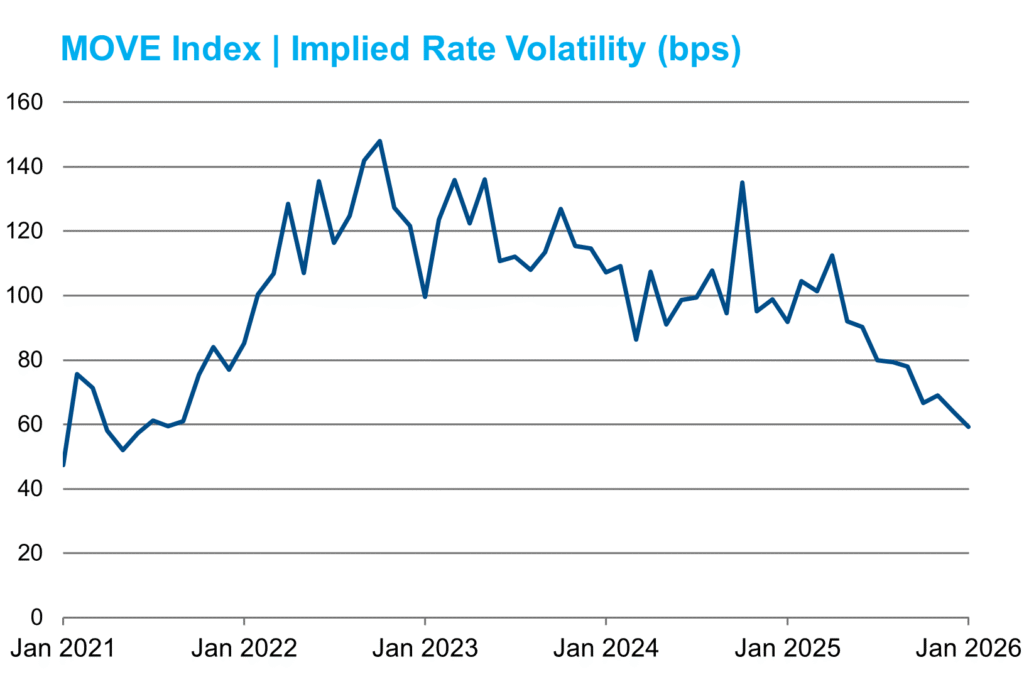

Despite elevated risks to both sides of the Fed’s dual mandate, concerns about Fed independence, and long-run fiscal sustainability, forward-looking measures of rate volatility decreased throughout 2025 and continued to decline in January. Implied rate volatility is currently at the lowest level since 2021 as market expectations are for the Fed to keep rates near current levels throughout the year.

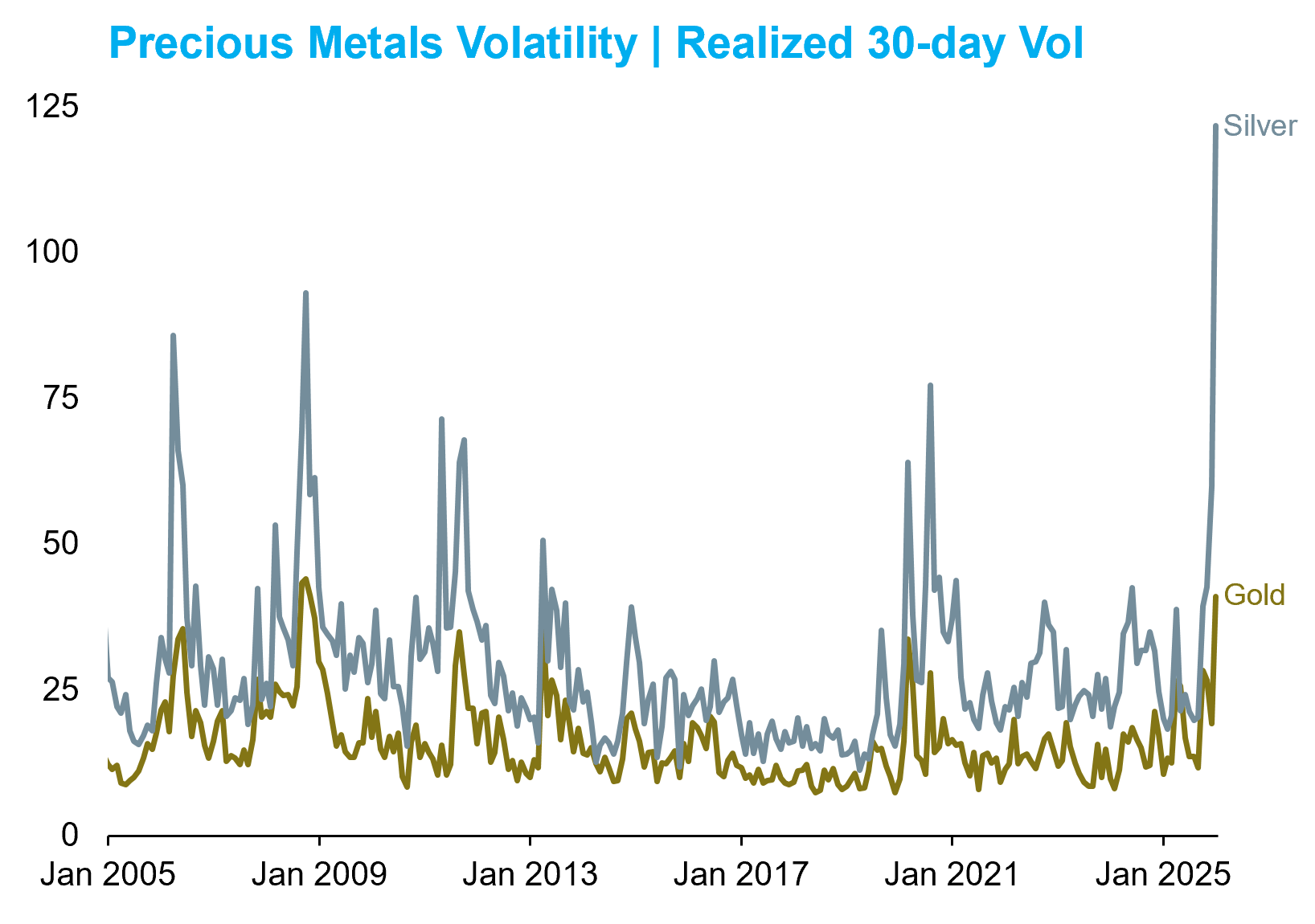

While rate and equity markets were relatively quiet in January, several commodity markets experienced significant volatility. In particular, silver and gold markets experienced wild swings, setting new all-time highs before closing the month with dramatic sell-offs. Realized volatility for silver ended at the highest level in the prior 20 years, while gold volatility ended near the peak level experienced during the 2008 financial crisis.

What Stands Out

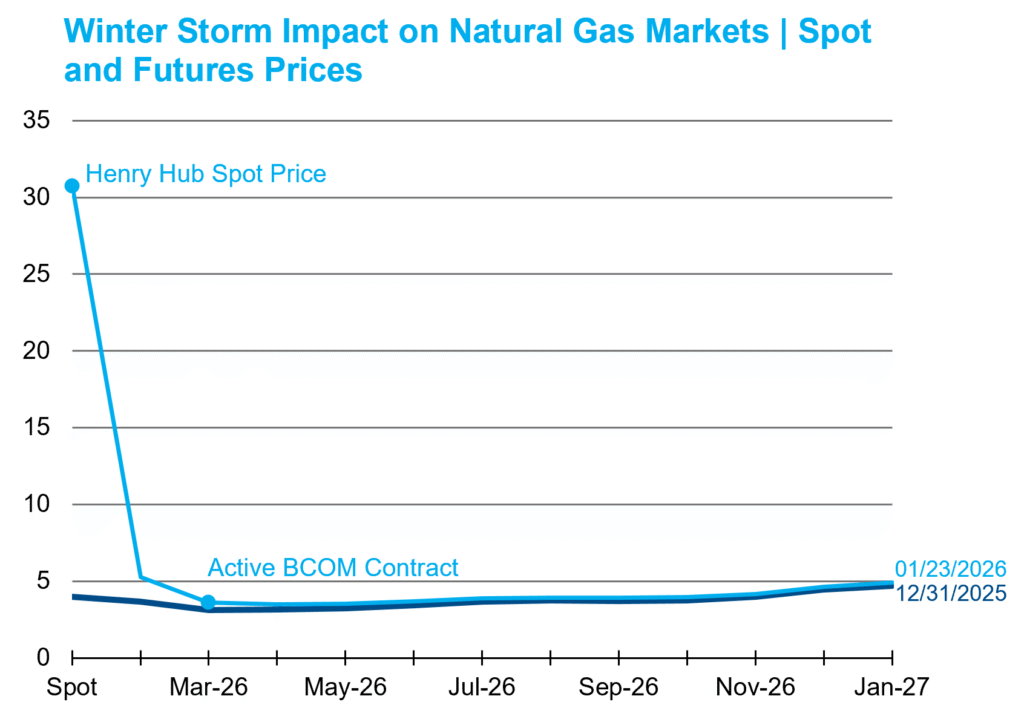

The significant winter storm that impacted much of the country provided a reminder of the dislocations that can occur in energy markets due to disruptions in supply and demand. The cost of next-day natural gas delivery at Henry Hub[1] increased to an all-time high of over $30/MMBtu on January 23, a more than seven-fold increase from the start of the month. As demand increased and supply was disrupted by temporary factors, the pricing impact was limited to spot and near-term delivery months. While the price moves for futures contracts appear minor compared to spot prices, the BCOM natural gas index returned 39% for the month. The February contract finished trading on January 28 at $7.46/MMBtu, more than 100% above the December 31 closing price.

[1] Please refer to the glossary for more information.

Data as of January 31, 2026. Sources: Bloomberg Index Services Ltd., Bloomberg, iVolatility, dealer indications, NISA calculations.

Glossary

What is the MOVE Index? The ICE BofA MOVE Index measures U.S. bond market volatility by tracking a basket of OTC options on U.S. interest rate swaps. The index tracks implied normal yield volatility of a yield-curve-weighted basket of at-the-money one-month options on the 2Y, 5Y, 10Y and 30Y constant maturity interest rate swaps. The index value is equal to the average of the implied normal yield volatility of the four options, where the 10Y option is given a 40% weight, and the other components each hold a 20% weight.

What is the VIX Index? The VIX Index is a calculation designed to produce a measure of constant 30-day expected volatility of the U.S. stock market derived from mid-quote prices of the S&P500 Index call and put options.

What is the Henry Hub? Henry Hub is a key distribution point on the natural gas pipeline system in Erath, Louisiana. It is the delivery point for natural gas futures contracts traded on the New York Mercantile Exchange (NYMEX). Spot prices represent the price for next-day delivery while futures prices represent the cost of delivery during the specified delivery month.

What is a 3Mx10Y USD Swaption? A swaption is the option to enter into an interest rate swap. The 3Mx10Y USD Swaption is a three-month option giving the purchaser the right to enter into a 10-year interest rate swap.

This overview is for informational purposes only. The information has been obtained from sources considered to be reliable, but the accuracy and completeness are not guaranteed. There is no assurance that any economic trends mentioned will continue or that any forecasts will occur. Economic data are as of the dates noted.

Disclosure Information

By accepting this material, you acknowledge, understand and accept the following:

This material has been prepared by NISA Investment Advisors, LLC (“NISA”). This material is subject to change without notice. This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) NISA is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, (iii) that you are capable of understanding and assessing the merits of a course of action and evaluating investment risks independently, and (iv) to the extent you are acting with respect to an ERISA plan, you are deemed to represent to NISA that you qualify and shall be treated as an independent fiduciary for purposes of applicable regulation. NISA does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein. You may not rely on the material contained herein. NISA shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of NISA except for your internal use. This material is being provided to you at no cost and any fees paid by you to NISA are solely for the provision of investment management services pursuant to a written agreement. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a client of NISA and (ii) the terms contained in any applicable investment management agreement or similar contract between you and NISA.