By: Daniel A. Scholz, CFA, Director, Investment Strategies and Aleksandr G. Panchenko, Senior Manager, Client Services

As we are all well aware, stubbornly high inflation dominated headlines in 2022 and has been a significant contributor to elevated market volatility. Even if the stubbornly high inflation of 2022 is beginning to abate in Q1 2023, the lessons it can teach us remain relevant. It should be no surprise that inflation protection strategies have regained popularity among investors, with a natural focus on what, if any, role Treasury Inflation Protected Securities (TIPS) may have in an asset allocation profile. While some investors may gravitate toward an allocation to TIPS for tactical reasons associated with a view on inflation, other investors may consider an allocation to TIPS for more strategic reasons. For example, investors whose liabilities contain a sensitivity to inflation may consider TIPS to be a more effective hedge against their liabilities than nominal securities.

The liabilities associated with Nuclear Decommissioning Trusts contain significant inflation sensitivity, and yet the adoption rate among NDT sponsors for utilizing TIPS in NDTs is apparently relatively low. According to NISA’s 2020 NDT Survey data, TIPS were used by only three respondents while another three reported that they were considering an allocation to TIPS. Our clients in the NDT community can attest that NISA has long maintained that TIPS could play a vital role in an NDT asset allocation, and with inflation at levels not seen in decades, we believe the case for TIPS is as strong as ever.

While there are multiple factors that affect an NDT sponsor’s asset allocation mix, we believe there are two principal reasons why the adoption of TIPS in NDT asset allocations has historically been low, notwithstanding the inherent nature of inflation in the associated liabilities. First, the cost of making a strategic adjustment may have been viewed as unacceptable. Second, the reality that the inflation compensation associated with TIPS does not correlate perfectly with the inflation sensitivities embedded in NDT liabilities may have given investors pause.

- The cost of making a strategic adjustment

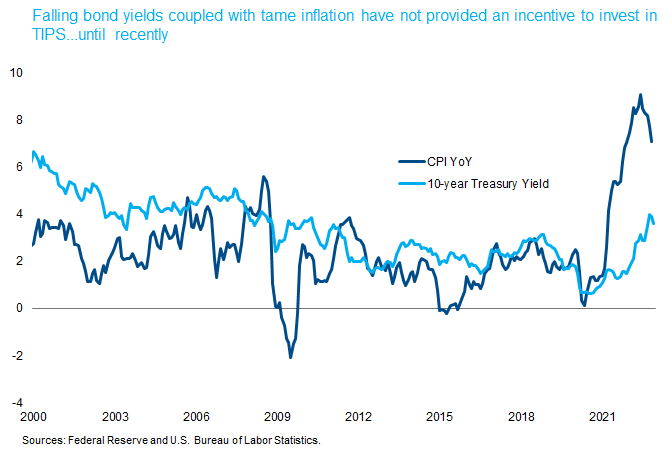

Until recently, interest rates have been falling (except for brief, sporadic periods) for the most part over the past 20+ years. This meant that existing allocations to fixed income securities likely were at embedded gains. Given the fact that TIPS are U.S. Treasury securities, with no inherent expected return above that of nominal U.S. Treasury securities, it is possible some investors simply chose not to realize gains to shift from nominal Treasuries to TIPS. The market reality of falling rates, coupled with the economic reality that realized inflation was very low for many years, makes the lack of motivation to change an asset allocation to TIPS understandable. The market and economic realities of 2022 which resulted in materially higher interest rates may suggest the time is right for such a change.

- Imperfect Hedge

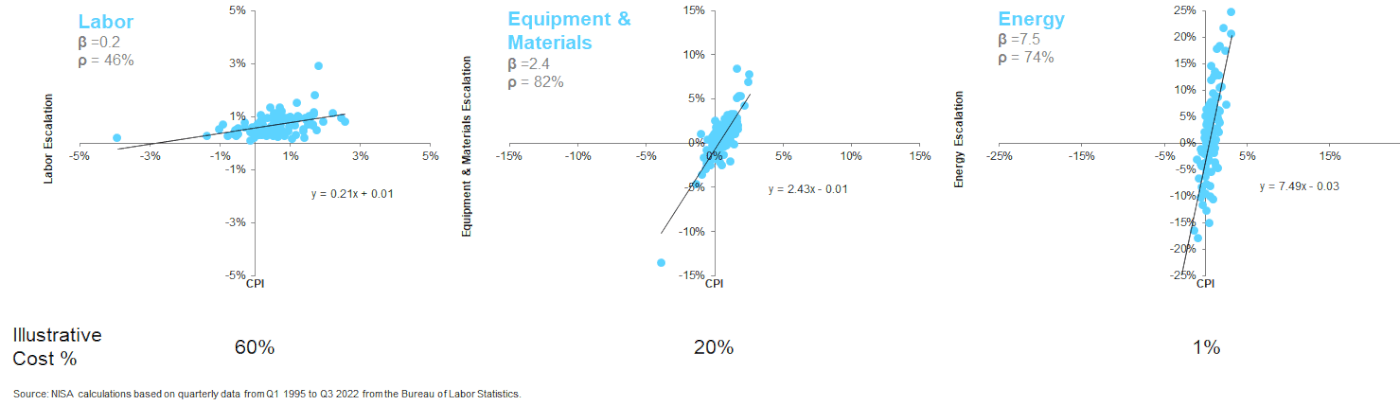

A second reason for the historical reticence of NDTs to allocate assets to TIPS may have been the uncertainty of the relationship between the escalation rates associated with the cost components of NDT liabilities (Labor, Equipment & Materials, Burial, Energy and Other) and the inflation compensation associated with TIPS (CPI-U[1]). The framework outlined below may be helpful in addressing that uncertainty. Perhaps obviously, the key question to be answered is whether NDT liability escalation rates are correlated with CPI. If yes, there likely is a strategic role for TIPS in an NDT asset allocation profile. Acknowledging some imperfection to the approach, we can use the correlation between each escalation rate and CPI to estimate how much of a role TIPS could play in an NDT’s asset allocation, according to the following formulas:$TIPS = β x $Liability, and

$Nominals = (1 – β) x $Liability, where

β = (σEscalation Rate / σCPI-U) x ρ(Escalation Rate, CPI-U)

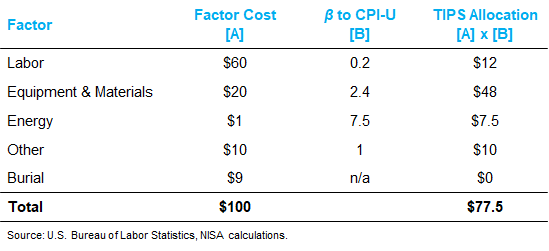

Conceptually, this demonstrates that a hedge ratio of exposure to CPI inflation (obtained via TIPS) can be identified for the various escalation rates associated with an NDT liability.Three of the five component costs mentioned above have readily identifiable measures of inflation: Labor, Equipment & Materials and Energy. The historical relationships between these liability components and CPI are depicted in the scatter plots below. As we can see, all three components are positively correlated with CPI. For example, for Labor, its ~0.2 beta to CPI resulting from the regression implies that for every $100 of labor-sensitive liability, $20 would be allocated to TIPS and $80 to nominals.Note that both Equipment & Materials and Energy reflect a beta larger than 1, which may be a bit abstract to think through. To use the extreme example of Energy, the beta of 7.5 suggests $750 of TIPS are needed to hedge $100 of Energy-sensitive liability, but this would also mean $-650 of nominals are utilized to fund that exposure to TIPS. In essence, a levered exposure to CPI is needed in the case of Energy. Perhaps this shouldn’t be too surprising, as the outsized volatility of energy inflation is well known to economists and market participants. Even if such a large hedge ratio might raise an eyebrow, it is worth pointing out that Energy is typically the smallest cost component to liabilities at less than 5% of total liability value, so the overall impact of this high hedge ratio on the full portfolio is fairly small.With respect to the Other category of cost inflation, it may be very reasonable to model this as a general inflation measure such as CPI, in which case the hedge math becomes very simple: hedge $1 of Other inflation sensitive liability with $1 of CPI exposure.Finally, Burial inflation does not have very reliable sources of data and may therefore possess a high degree of uncertainty relative to CPI. For this reason, we do not attempt to measure a TIPS’ hedge ratio for this cost component. It is our view, however, that just because it may be unclear how to handle this component of the liability, it is not an argument to discard the hedge benefits TIPS provide to the other four cost components where an allocation to TIPS is appropriate and justifiable.As has been demonstrated, the TIPS hedge against a full liability might look as follows, per $100 of liability:

For example, for Labor, its ~0.2 beta to CPI resulting from the regression implies that for every $100 of labor-sensitive liability, $20 would be allocated to TIPS and $80 to nominals.Note that both Equipment & Materials and Energy reflect a beta larger than 1, which may be a bit abstract to think through. To use the extreme example of Energy, the beta of 7.5 suggests $750 of TIPS are needed to hedge $100 of Energy-sensitive liability, but this would also mean $-650 of nominals are utilized to fund that exposure to TIPS. In essence, a levered exposure to CPI is needed in the case of Energy. Perhaps this shouldn’t be too surprising, as the outsized volatility of energy inflation is well known to economists and market participants. Even if such a large hedge ratio might raise an eyebrow, it is worth pointing out that Energy is typically the smallest cost component to liabilities at less than 5% of total liability value, so the overall impact of this high hedge ratio on the full portfolio is fairly small.With respect to the Other category of cost inflation, it may be very reasonable to model this as a general inflation measure such as CPI, in which case the hedge math becomes very simple: hedge $1 of Other inflation sensitive liability with $1 of CPI exposure.Finally, Burial inflation does not have very reliable sources of data and may therefore possess a high degree of uncertainty relative to CPI. For this reason, we do not attempt to measure a TIPS’ hedge ratio for this cost component. It is our view, however, that just because it may be unclear how to handle this component of the liability, it is not an argument to discard the hedge benefits TIPS provide to the other four cost components where an allocation to TIPS is appropriate and justifiable.As has been demonstrated, the TIPS hedge against a full liability might look as follows, per $100 of liability: Allocating $77.5 of assets to TIPS for every $100 of liability may not be palatable to some, as investments in return-seeking assets may be desirable. Should that be the case, synthetic exposure to TIPS may be obtained in the marketplace, in addition to or as a substitute for physical exposure.

Allocating $77.5 of assets to TIPS for every $100 of liability may not be palatable to some, as investments in return-seeking assets may be desirable. Should that be the case, synthetic exposure to TIPS may be obtained in the marketplace, in addition to or as a substitute for physical exposure.

In summary, given the economic reality of elevated inflation, the case for inflation protection in NDTs may be as strong as it has ever been. And, given the market reality of increasing interest rates, the cost to transition to TIPS to provide that inflation protection may be acceptable.

As you consider your opportunities for hedging inflation in the new year, please reach out to us to discuss this or other considerations you may have regarding TIPS in an NDT.

[1] Consumer Price Index for All Urban Consumers (colloquially known as the CPI). Published by the Bureau of Labor Statistics. More information available at https://www.bls.gov/cpi/.