Economic and Market Overview

January 2026

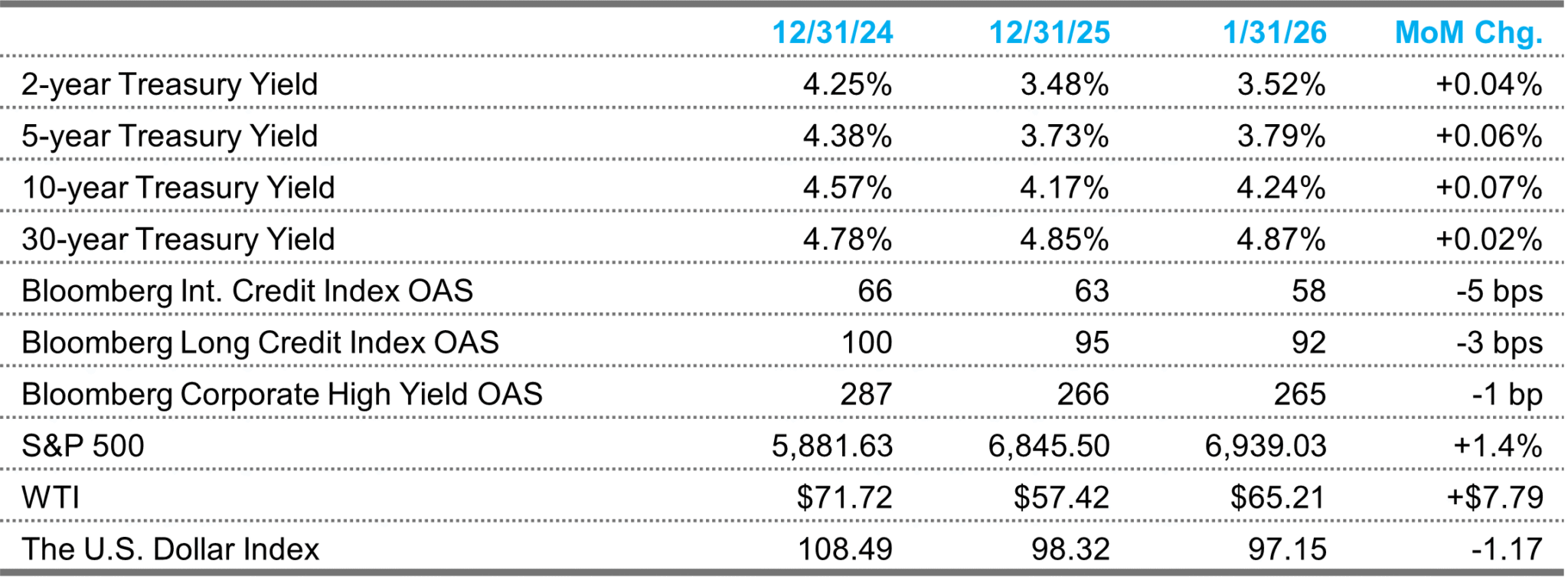

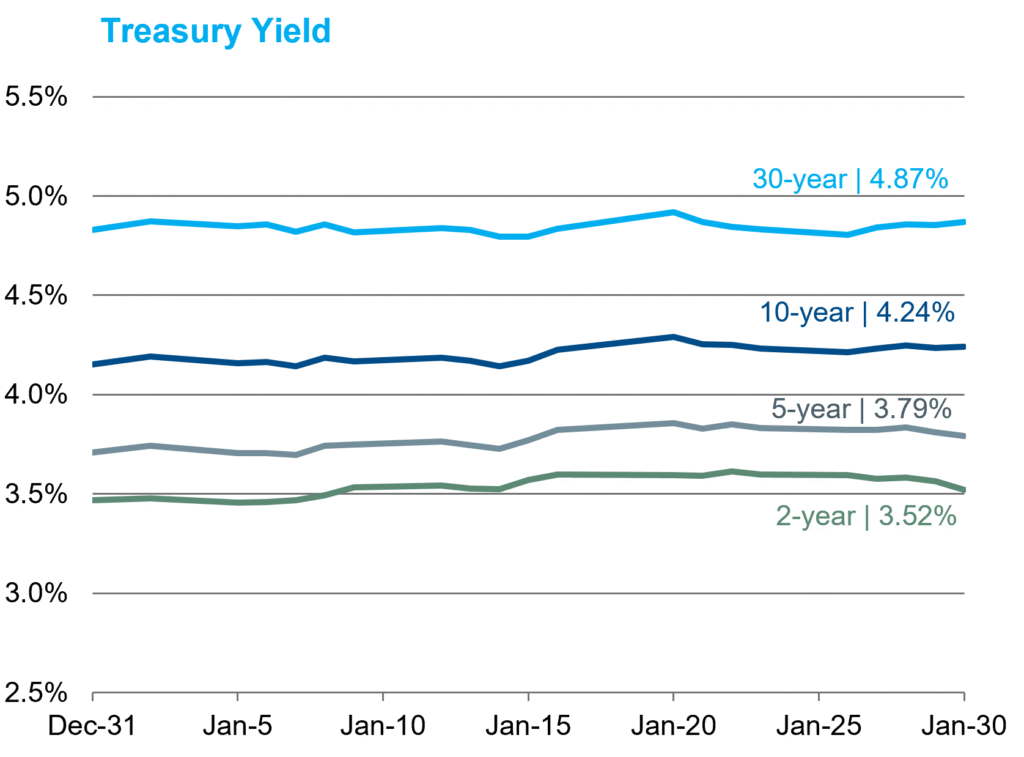

Equities gained, oil surged and credit spreads tightened, while Treasuries sold off over a month filled with geopolitical intrigue. The FOMC held the policy rate unchanged for the first time since July, and President Trump nominated Kevin Warsh to head the central bank.

Markets

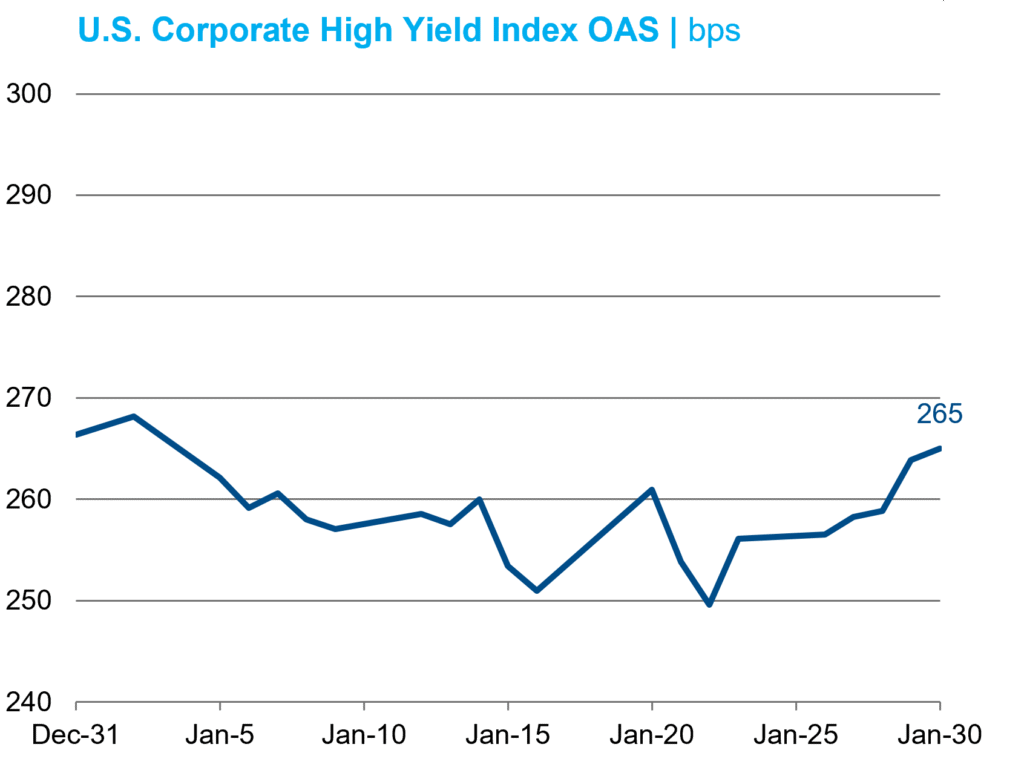

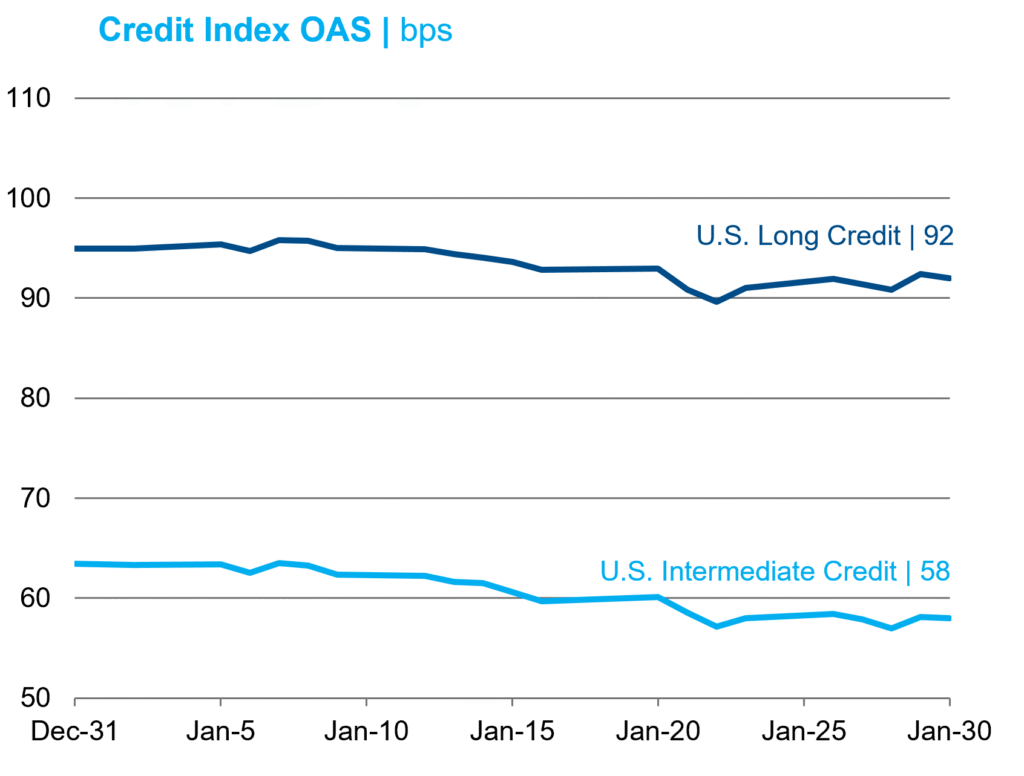

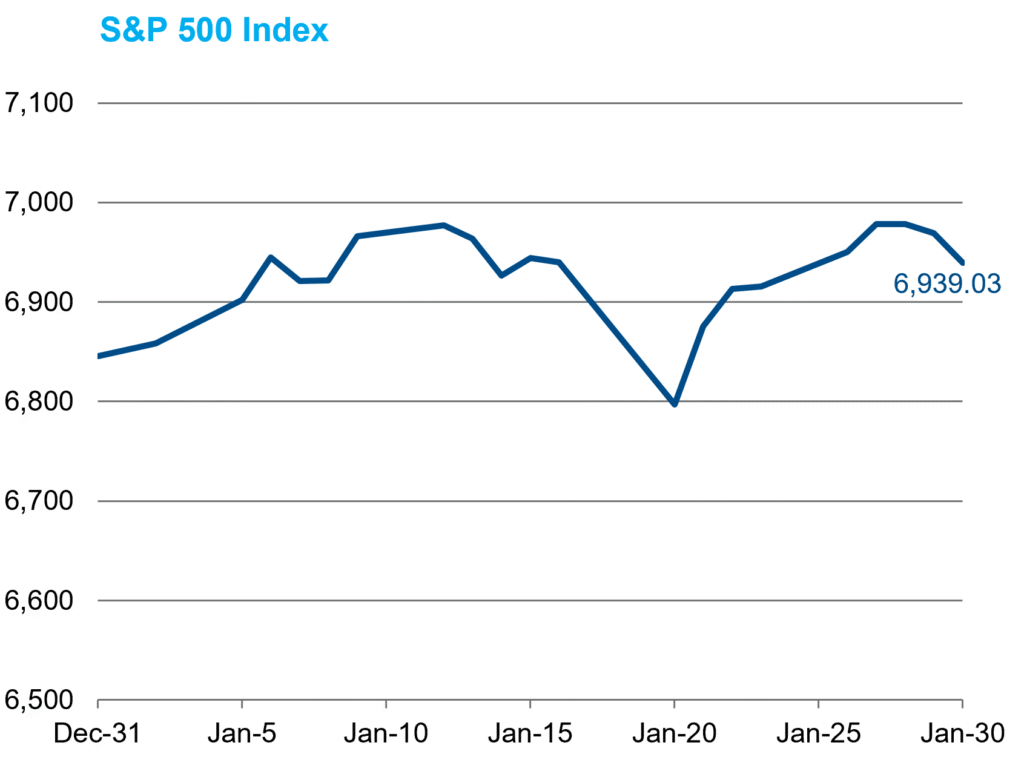

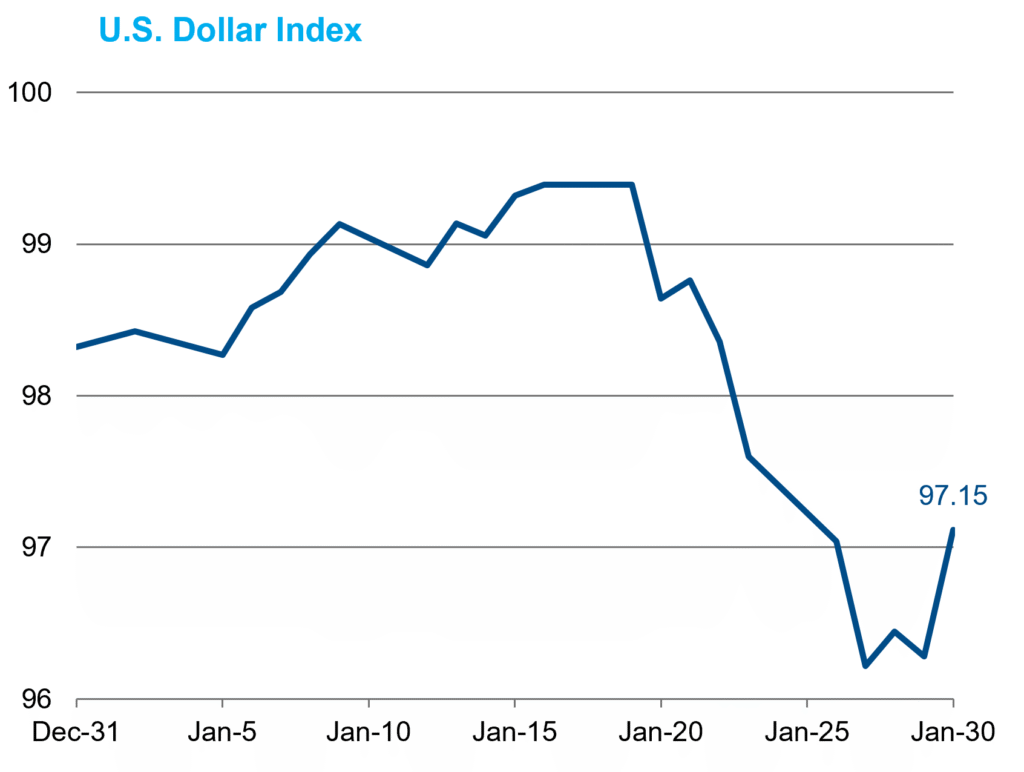

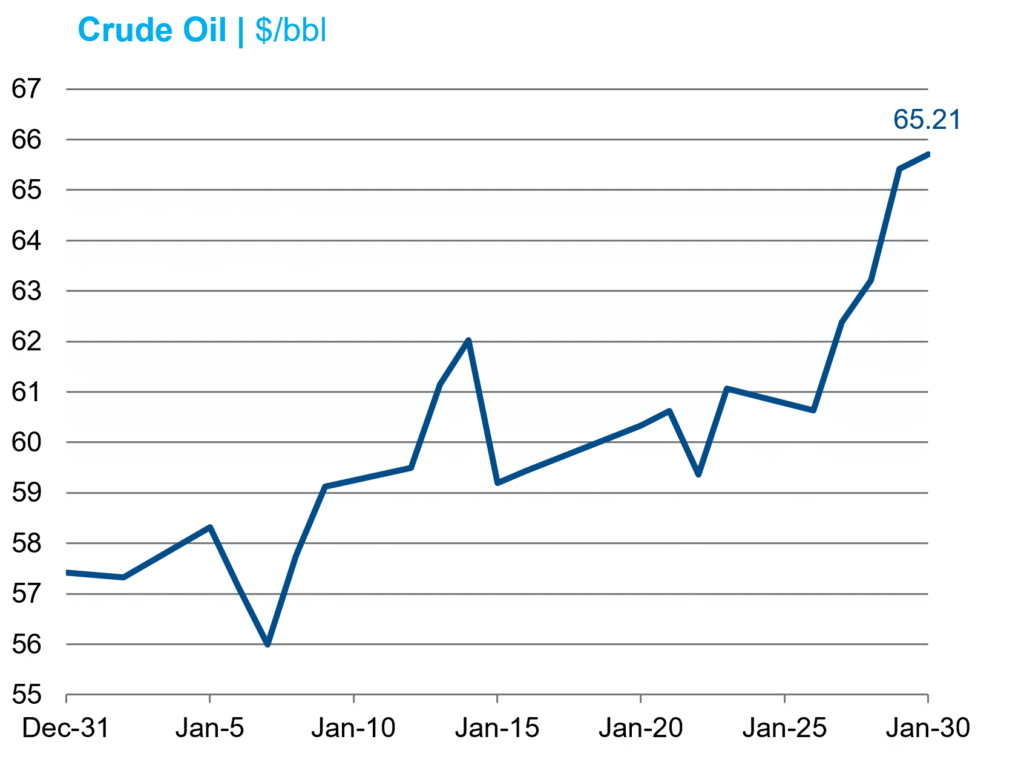

The S&P 500 gained 1.4% to start the year, weathering a brief nosedive at the end of the second trimester on short-lived concerns that President Trump may seek to take Greenland by force. Megacap tech performance was mixed, but the equally weighted index returned 3.4%. Oil stocks did well as crude surged late in the month on heightened geopolitical tensions and winter storm activity in much of the United States. The Treasury market was relatively volatile, but when all was said and done, yields settled single digits higher across the curve. Credit spreads tightened even as the primary market sprang to life to start the new year. J.P. Morgan reported $217 billion in total investment-grade issuance, a record for the month and 29% over the average January since 2022. High yield issuance for the month totaled $30 billion, which was in line with the average. The Dollar Index jumped nearly a point on the final day as President Trump at last announced his pick to succeed Jerome Powell as Fed Chairman (see below), but still extended its monthly losing streak to three. Dollar weakness was also reflected in the continued surge in precious metals prices, with gold increasing by 13.3% in the month despite a 9.7% plunge in the final two sessions.

Economic Data

Government agencies made significant strides in catching up on data releases over the month. Nonfarm payrolls rose at a 50k pace in December and the release included a 76k net reduction in the prior two months’ figures. The unemployment rate came in 0.1% below expectations at 4.4% and November’s hiking cycle high was revised 0.1% lower to 4.5%. Retail sales growth was solid in November (+0.6%), topping estimates by 0.1%, though the prior month was revised 0.1% lower to -0.1%. Consumer sentiment indices were decidedly at odds with one another, however. The University of Michigan’s came in at 56.4, beating consensus by 2.4, and then days later, the Conference Board shocked observers by announcing its lowest reading since 2014. In manufacturing, durable goods and factory orders posted strong gains in November, while sentiment surveys were solid overall. A slew of housing releases covering the prior few months were mixed. The third release of Q3 GDP was nudged up 0.1% to 4.4% while personal consumption was unchanged at 3.5%. For the fourth quarter, economists expect growth to slow to around a 2.0% pace.

Inflation

CPI data returned to its pre-shutdown cadence, as the Bureau of Labor Statistics announced a 0.3% MoM pace for the headline index and a 0.2% rate for the core index on January 13. The latter was 0.1% under consensus. PCE is still running late, but the October and November data were in line with surveys, while the December release is due on February 20. The month included three months’ worth of PPI data; October and November’s numbers were released mid-month and were fairly tepid, but December data at month-end was hotter than expected across the board. Near-term inflation expectations jumped on the back of oil’s gain, with the 2y and 5y points finishing 54 bps and 29 bps higher, at 2.84% and 2.56%, respectively, while the 30y rate was up just 5 bps, to 2.27%.

Federal Reserve

The FOMC held policy unchanged at their January meeting, as they had signaled they would. The statement highlighted a stronger growth outlook, and Chairman Powell emphasized tentative signs of stabilization in the labor market during his press conference. He also highlighted a reduction in stagflationary pressures, noting that “the upside risks to inflation and the downside risks to employment have probably both diminished a bit.” We continue to believe that the Fed will remain on hold through the summertime before cutting twice in the final months of the year. President Trump announced Kevin Warsh as his nominee to succeed Powell as Chairman—a conventional choice given the range of possible candidates Trump has considered over the years. Senator Tillis strenuously reaffirmed his position that he will not vote to advance any Fed nominee out of the Senate Banking Committee until the DOJ investigation into Chairman Powell is resolved. Once that roadblock is cleared, we expect Warsh will be confirmed by a comfortable margin and assume office before the June FOMC meeting.

Sources: Bloomberg Index Services Ltd., Bloomberg.

This overview is for informational purposes only. The information has been obtained from sources considered to be reliable, but the accuracy and completeness are not guaranteed. There is no assurance that any economic trends mentioned will continue or that any forecasts will occur. Economic data are as of the dates noted.

Disclosure Information

By accepting this material, you acknowledge, understand and accept the following:

This material has been prepared by NISA Investment Advisors, LLC (“NISA”). This material is subject to change without notice. This document is for information and illustrative purposes only. It is not, and should not be regarded as “investment advice” or as a “recommendation” regarding a course of action, including without limitation as those terms are used in any applicable law or regulation. This information is provided with the understanding that with respect to the material provided herein (i) NISA is not acting in a fiduciary or advisory capacity under any contract with you, or any applicable law or regulation, (ii) that you will make your own independent decision with respect to any course of action in connection herewith, as to whether such course of action is appropriate or proper based on your own judgment and your specific circumstances and objectives, (iii) that you are capable of understanding and assessing the merits of a course of action and evaluating investment risks independently, and (iv) to the extent you are acting with respect to an ERISA plan, you are deemed to represent to NISA that you qualify and shall be treated as an independent fiduciary for purposes of applicable regulation. NISA does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein. You may not rely on the material contained herein. NISA shall not have any liability for any damages of any kind whatsoever relating to this material. No part of this document may be reproduced in any manner, in whole or in part, without the written permission of NISA except for your internal use. This material is being provided to you at no cost and any fees paid by you to NISA are solely for the provision of investment management services pursuant to a written agreement. All of the foregoing statements apply regardless of (i) whether you now currently or may in the future become a client of NISA and (ii) the terms contained in any applicable investment management agreement or similar contract between you and NISA.