Leaders in Risk-Controlled Asset Management

Since 1994, we have actively managed risk for our clients, providing clarity to complicated challenges and stability in ever-evolving markets.

World-leading organizations rely upon NISA Investment Advisors to design, develop and manage highly customized, risk-controlled investment strategies. Based in St. Louis, Missouri, we employ over 400 people, over 20% of whom have a participation interest in the firm.

Disciplined Growth

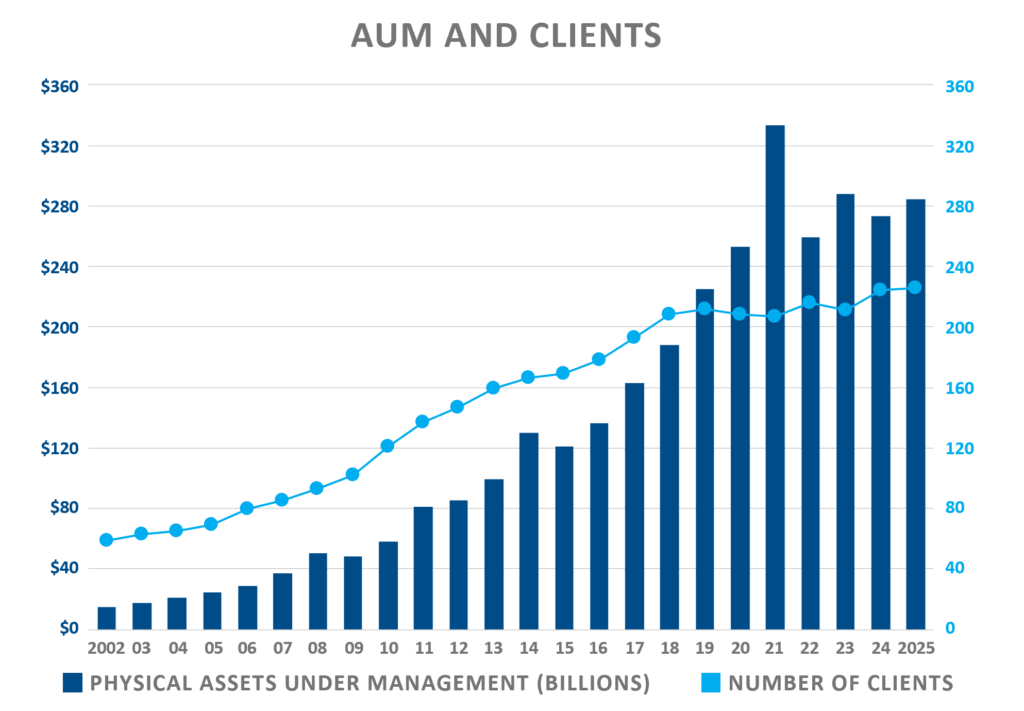

Since its inception, NISA has maintained discipline regarding our growth of both clients and assets. Large, risk-controlled and liability-aware portfolios have been a mainstay since the company’s founding. Product expansion has generally been a direct result of client input.

With a median client engagement of over $440 million, we recognize the importance of managing growth carefully. As such, we typically add a limited number of new relationships each year. Fundamental to this discipline has been a continuous expansion of staff in advance of workload demands.

Our Future

Since 1994, we have taken the long view when it comes to our client and employee relationships. We anticipate a continuation of our measured growth, in terms of assets, clients and employees. From time to time, we have discussions with clients regarding extending our investment style and approach to new products and markets, which will likely lead to a gradual expansion of investment products.

We believe employee ownership provides a stability and independence that is a key competitive strength in the asset management industry. We have no plans to change our ownership structure beyond NISA employees.

Founding

NISA’s founders, Jess Yawitz and Bill Marshall, began their careers as professors at Washington University in St. Louis, where they were early pioneers in research on fixed income investing and the concepts of interest rate risk management and immunization. After leaving academia to work on Wall Street, Jess and Bill returned to St. Louis, founding NISA Investment Advisors, LLC in 1994 as a firm focused on fixed income investing for large institutional investors.

2025 Assets Under Management is as of 3/31/2025.

The data supplied by NISA are based on trade date and calculated according to NISA’s pricing policies. NISA maintains the data only for its portfolio management, guideline verification and performance calculation purposes and the data may differ from the recordkeeper. NISA does not provide pricing, recordkeeping, brokerage or any related services. A summary of NISA’s Pricing and Valuation policy is available upon request.

NISA Investment Advisors, LLC does not purport to and does not, in any fashion, provide tax, accounting, actuarial, recordkeeping, legal, broker/dealer or any related services. You should consult your advisors with respect to these areas and the material presented herein.